coinbase vs coinbase pro taxes

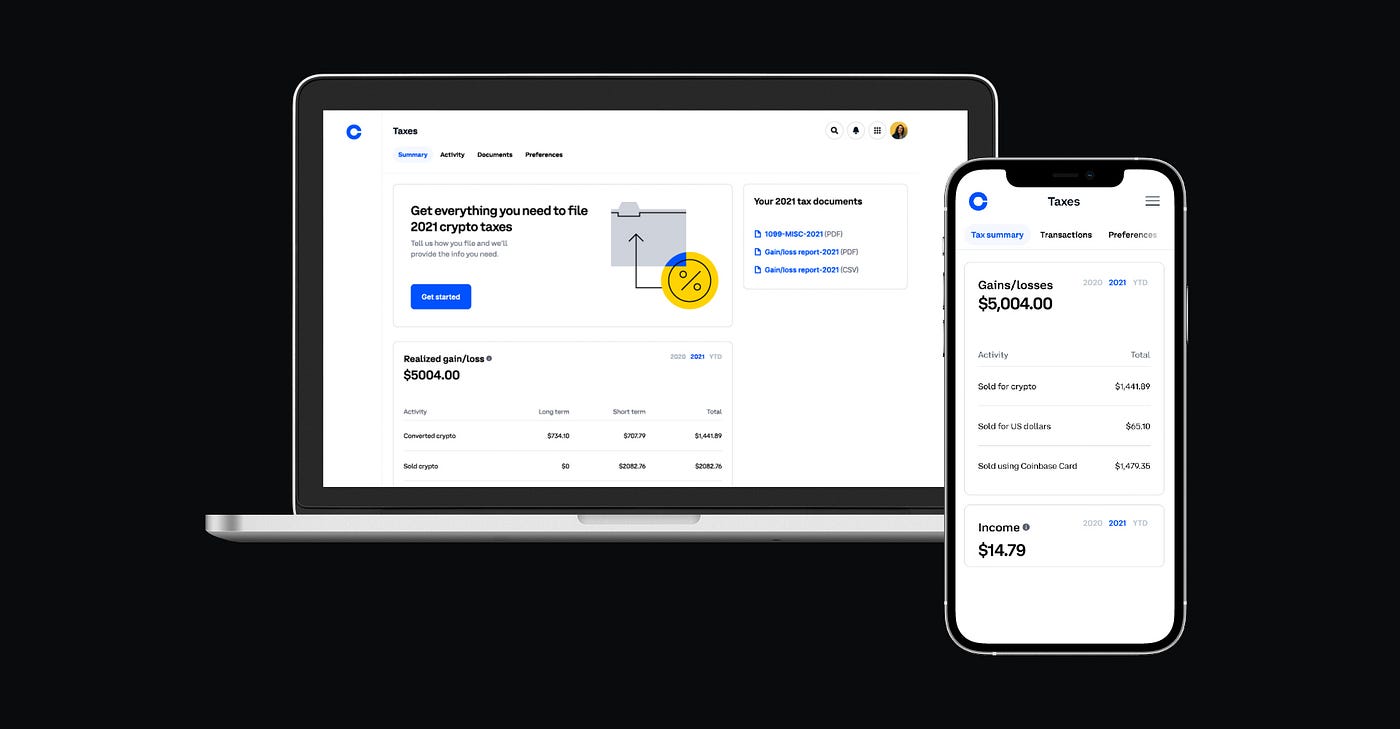

While Coinbase doesnt issue 1099-Ks they do issue the 1099-MISC form and report it to the IRS. Coinbase Taxes will help you understand.

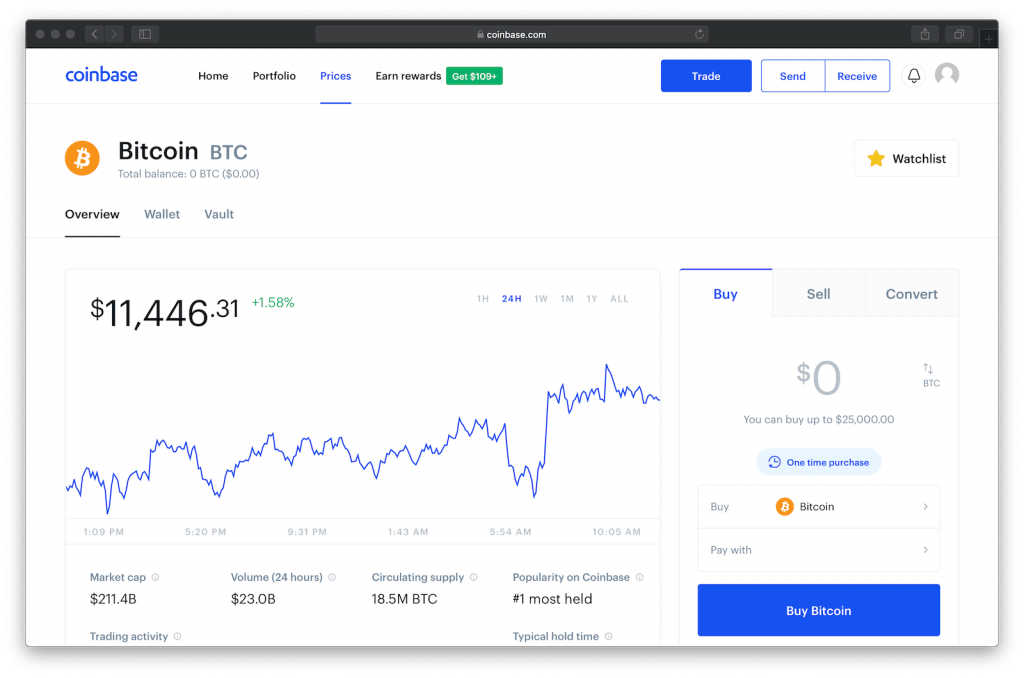

Coinbase Vs Coinbase Pro Is The Upgrade Worth It Zenledger

Trade Republic offers derivatives trading on a range of currencies.

. I deposited 1000 but didnt buy anything yet. Leave the IP whitelist blank. If you do not have a ton of selling transactions you can just enter each line of 8949 manually with your tax sw or paper.

Trade Republic offers over 40000 derivatives assets including CFDs with no commission charges or spread mark-ups. In order to pay 15 tax I plan to hold them for at least 1 year. Coinbase Earn Crypto.

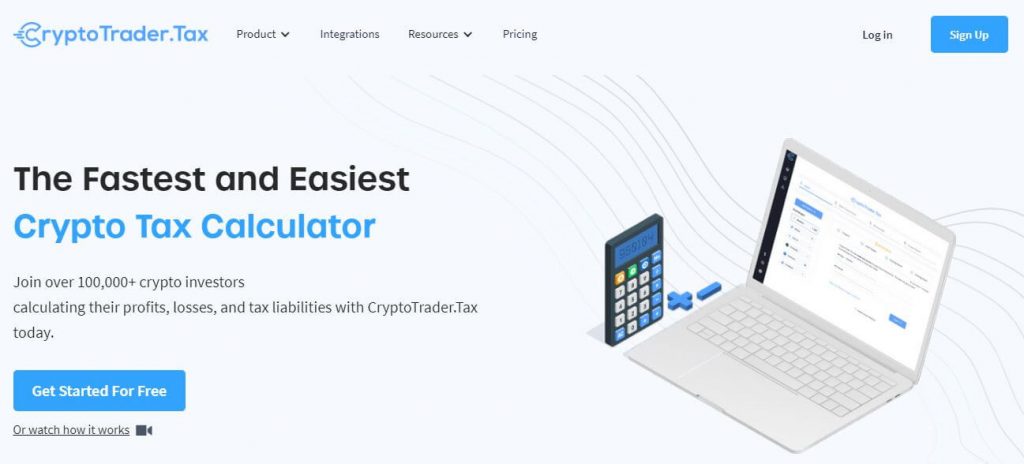

Find Coinbase Pro in the list of supported exchanges and select the import method you prefer. Line height 12px margin 20px text transform uppercase media min width 960px toc header font size 12px line height 14px toc line atoc item color 111 font size 14px letter spacing 2px line. On Coinbase and Coinbase Pro all taxable transactional history can be recorded by third-party crypto tax calculating software automatically and on all exchanges.

Compare price features and reviews of the software side-by-side to make the best choice for your business. Mod 4 mo. Under Permissions select View.

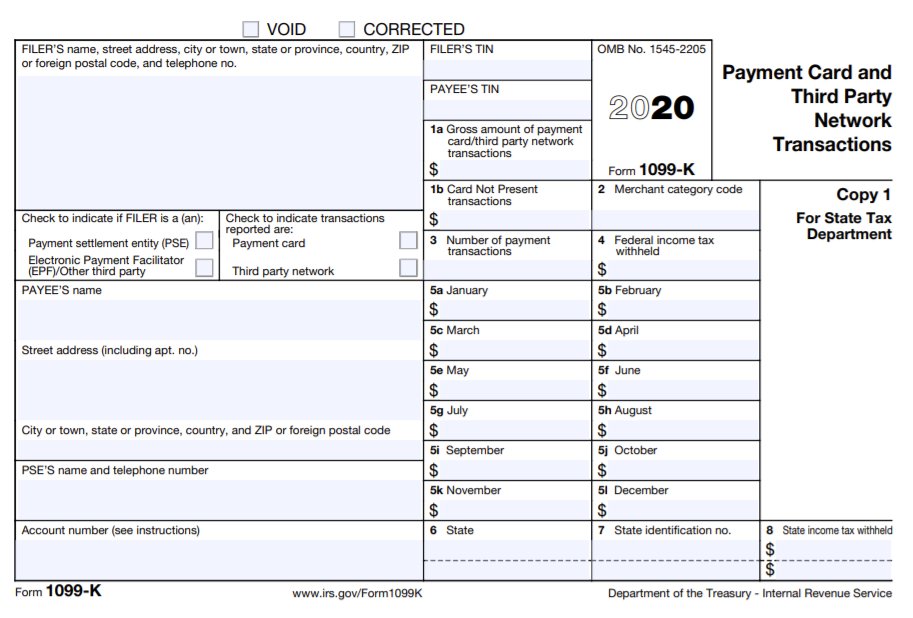

Note Coinbase Pro is one of the highest fees in the US among pro exchanges so the fees are not great for a pro exchange. Support for FIX API and REST API. Youll receive the 1099-MISC form from Coinbase if you are a US.

Within CoinLedger click the Add Account button on the top left. A Coinbase Pro account gives you access to the Coinbase Pro crypto trading platform. Visit Coinbase Pro API page.

Coinbase charges a fee of 099 to 299 per trade depending on the size plus a spread of about 050 between buying and selling prices. Click your name Click statements And generate. Coinbase exchange charges a higher.

Beginners use Coinbase because its. I have had my coinbase account since 2016 never any issue using it except for the occasional re-verification of my identity ever year or so. Click Create API Key.

Thursday May 19 2022. Coinbase Tax Resource Center. On Coinbase Pro you only pay the.

Copy the Passphrase and paste into CoinTracker. Trade Bitcoin BTC Ethereum ETH and more for USD EUR and GBP. On Coinbase Pro I didnt to anything yet.

Click New API Key. These Coinbase pro trading fees start at 060 and fall as the monthly trading volume of more significant volume dealers increases. This trading platform is designed for fast-paced spot trading and offers pricing based.

On Coinbase I bought ETH to hold. Coinbase Pro is cheaper because youre doing all the work. NDAX using this comparison chart.

It is shown in the table below. Coinbase es la mayor bolsa de criptodivisas con sede en Estados Unidos y también es una de las mayores del mundo en cuanto a volumen de operaciones liquidez y. You can use Cointracker or Koinly to help generate a form 8949 if you.

Easily deposit funds via Coinbase bank transfer wire. The fees charged by Coinbase in the United States vary based on the mode of payment. Coinbase is like a brokerage with a virtual wallet whereas Coinbase Pro works as an exchange where people buy and sell from each other.

This subreddit is a public forum. I bought and sold 40000 in crypto last year on. Or connect the API read me to Crypto tax software.

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase 1099 Guide To Coinbase Tax Documents Gordon Law Group

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Shehan On Twitter Breaking 1 Next Year Coinbase Is Planning To Issue A New Crypto Tax Form 1099 Misc And Abandon The Old Form 1099 K Which Created A Tax Nightmare For Many Taxpayers

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

The Ultimate Coinbase Pro Taxes Guide Koinly

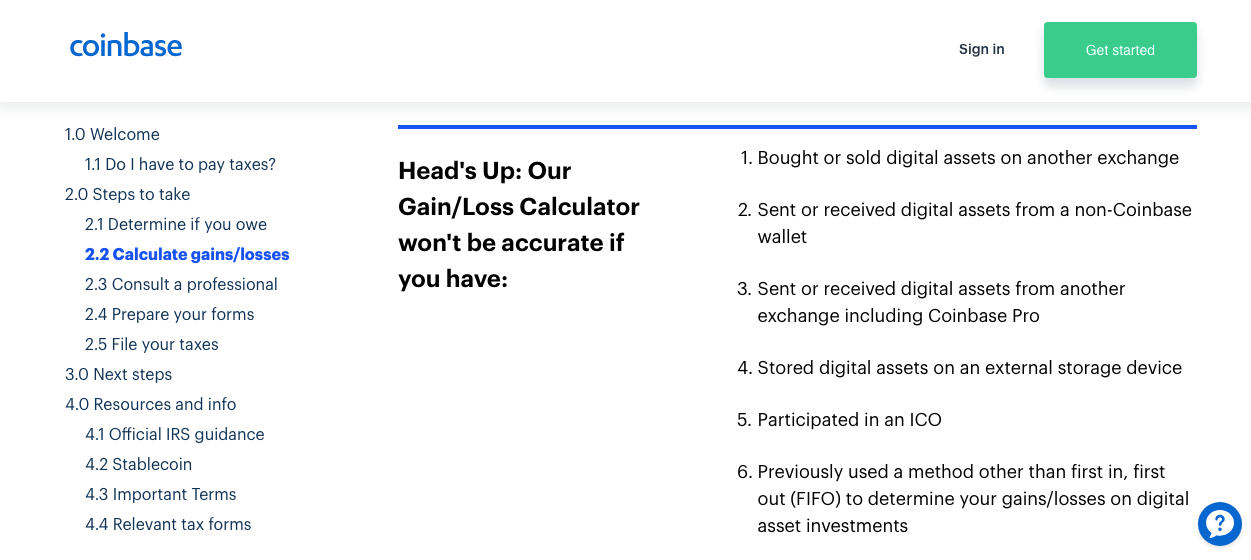

3 Steps To Calculate Coinbase Taxes 2022 Updated

Best Coinbase Tax Calculator 2022 How To Calculate Your Coinbase Coinbase Pro Taxes

![]()

Coinbase Makes It Easier To Report Cryptocurrency Taxes The Verge

Shehan On Twitter Breaking 1 Next Year Coinbase Is Planning To Issue A New Crypto Tax Form 1099 Misc And Abandon The Old Form 1099 K Which Created A Tax Nightmare For Many Taxpayers

The Coinbase Conundrum Providing Accurate Tax Information To Users By Lucas Wyland Hackernoon Com Medium

/Crypto_Com_Coinbase_Head_to_Head_Coinbase-5a1d16401652466496531dd1cf6e348a.jpg)

Crypto Com Vs Coinbase Which Should You Choose

The Ultimate Coinbase Pro Taxes Guide Koinly

3 Steps To Calculate Coinbase Taxes 2022 Updated

Best Coinbase Tax Calculator 2022 How To Calculate Your Coinbase Coinbase Pro Taxes

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

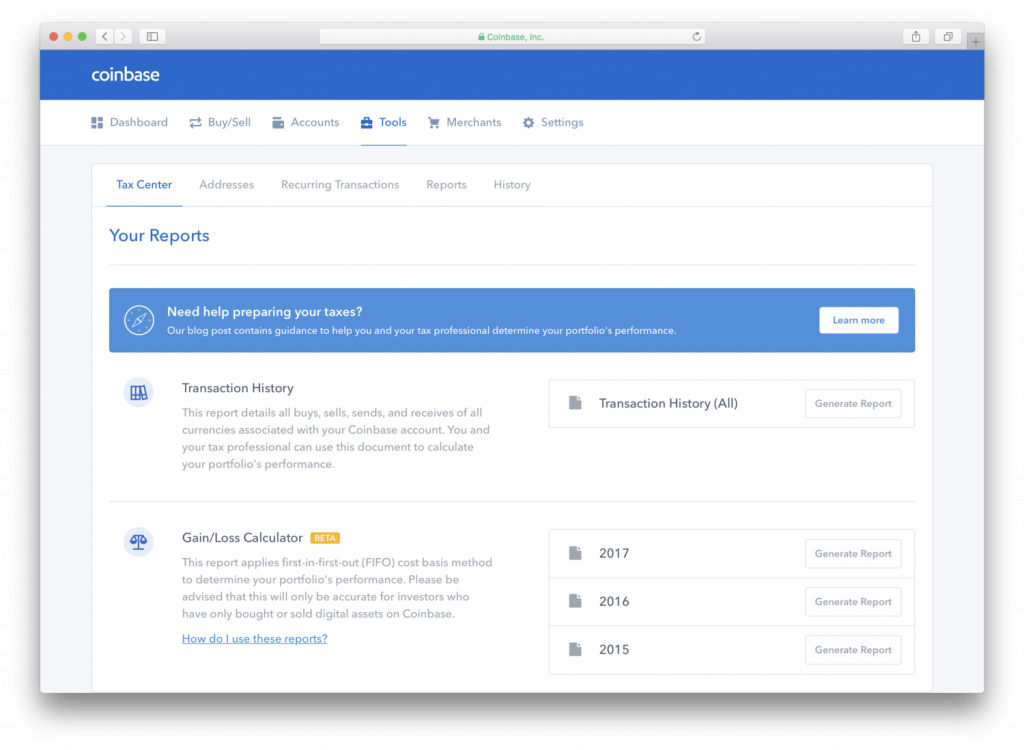

Coinbase Launches Cryptocurrency Trading Tax Calculator Taxes Bitcoin News

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog