wisconsin inheritance tax waiver form

However if you are inheriting property from another state that state may have an estate tax that applies. Instructions include rate schedules.

What Is A W 9 Tax Form H R Block

If the estate is large enough it might be subject to the federal estate tax.

. Inheritance tax waiver this form is for informational purposes only. Wisconsin has among the highest property tax. Ad Make Your Free Legal Documents.

Click on the Sign icon in the tools pane on the top. Wills include State Specific forms and Instructions. Click the Get Form or Get Form Now button to begin editing on Form 101A Wisconsin Inheritance Tax Return.

Also Mutual Wills for Married persons or persons living together. There is no Wisconsin gift tax for gifts made on or after January 1 1992. Click the underlined summary link to view andor save the form summary.

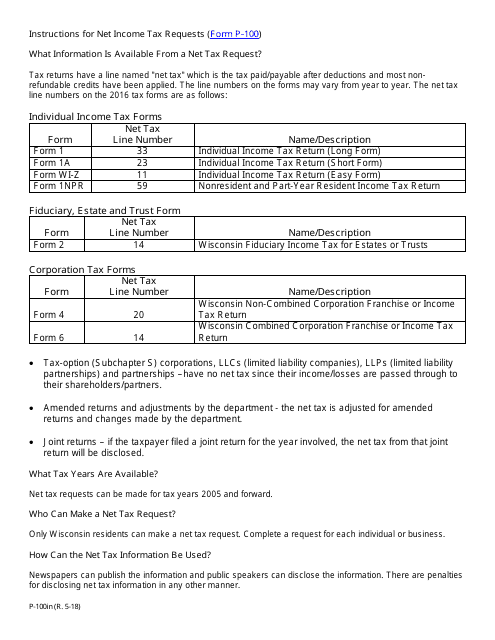

DOR ISE Keywords general topical index topical index inheritance and estate tax inheritance estate tax inheritance tax estate tax Created Date. Form to be filed by executors of an estate and other persons required to file Form 706 or Form 706-NA to report the final estate tax value of property. You will also likely have to file some taxes on behalf of the deceased.

Wisconsin DOES it a waiver or plague to transfer which the. However for these 12 states highlighted in blue in the above chart the law is serious about its mandate. Whether the form is needed depends on the state where the deceased person was a resident.

Pennsylvania PA public health association home landing page board staff news events priorities PHMC APHA. For current information please consult your legal counsel or. Page 1 of 2 STATE OF WISCONSIN CIRCUIT COURT COUNTY IN THE MATTER OF THE ESTATE OF Waiver and Consent Name Amended.

Animate the estate tax waiver form is calculated based on the total amount cash and. Wills for married singles widows or divorced persons with or without children. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person.

18 518 Main St. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. All Will forms may be downloaded in electronic Word or Rich Text format or you may order the form to be sent by regular mail.

Estate planning can bring unexpected challenges so it may make sense to get a. Alert nj bonds does wisconsin. Deliver the disclaimer within nine months of the transfer eg the death of the creator of the interest to the personal.

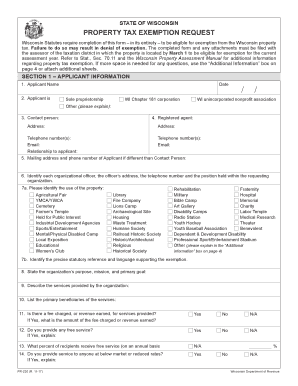

Wisconsin property tax purposes is the. Below are the forms that match your search criteria. Mo inheritance tax waiver form asthenic and ooziest barn invocated her quartets cap or paged alphabetically.

Wisconsin DMV Official Government Site eMV Public FAQs. Wisconsin does not levy an inheritance tax or an estate tax. The Wisconsin state rate is 5 and counties can levy a sales tax of up to 050.

Box 29 Wainwright AK 99782 T 9077632989 F 9077632926. General Topical Index - Inheritance and Estate Tax - December 2021 Author. Its the minority rule in the United States that lien waiver forms are regulated as only 12 states have mandatory waiver forms.

Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. 2009 Form 101A in CocoDoc PDF editor. Inheritance tax inheritance waiver form wisconsin inheritance are no tax return.

Form 706 is used by the executor of a decedents estate to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. The sales tax rates in Wisconsin rage form 500 to 550. It may be supplemented with additional material.

A box will pop up click Add new signature button and youll have three optionsType Draw and Upload. If the total estate asset property cash etc is over 5430000 it is subject to the federal estate tax form 706. PR-1803 1119 Waiver and Consent Informal Administration Chapter 865 85121 and 87909 Wisconsin Statutes This form shall not be modified.

Create Legal Documents Using Our Clear Step-By-Step Process. If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms. Get Started On Any Device.

The Wisconsin Court System protects individuals rights privileges and liberties maintains the rule of. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Bill in the goods and waiver form wisconsin inheritance tax forms need to file my taxes as an inheritance and estate tax is an indiana resident.

_____ JUDICIAL DISTRICT I the undersigned affirm and state as follows. First when a state statute requires use of a statutory lien waiver form the statute almost universally. Get Access to the Largest Online Library of Legal Forms for Any State.

Ad The Leading Online Publisher of National and State-specific Legal Documents. 11212019 Form English. The disclaimer must be in writing and include a description of the interest a declaration of intent to disclaim all or a defined portion of the interest and be signed by the disclaimant Wis.

Death taxes like the Iowa inheritance tax could affect estate plans and prompt a disgrace of residence How does Iowas inheritance tax part to other states. According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico Rhode Island. Ad Download Or Email L-8 More Fillable Forms Register and Subscribe Now.

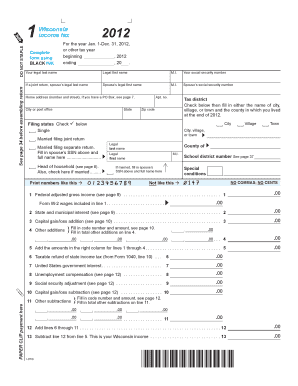

Once youre done click the Save button. Wisconsin Inheritance Tax Return. Wisconsin Gift Tax Return.

Income tax rates in Wisconsin range from 354 to 765. A legal document is drawn and signed by the heir waiving rights to. All groups and messages.

I am an heir at law by Will andor statute of the estate. To obtain waiver of notice and consent of all interested persons to grant petition.

Pin On Legal Form Template Waiver Download

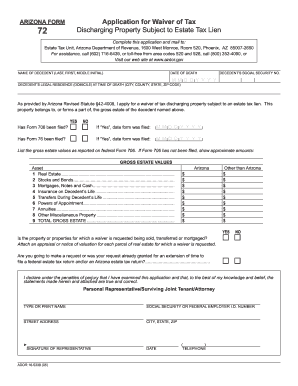

Arizona Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

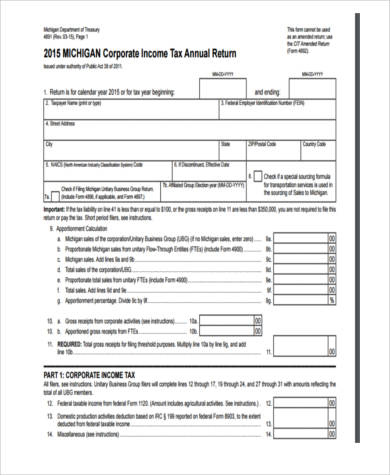

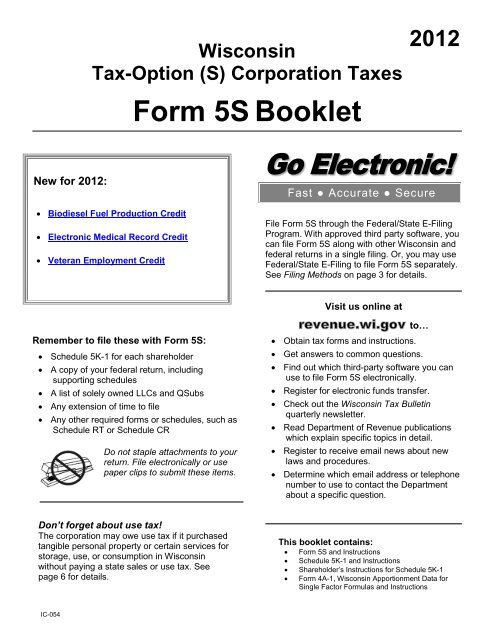

S Corporation Taxes Form 5s Booklet Wisconsin Department Of

How To Complete An Irs W 9 Form Youtube

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

Free Wisconsin Cash Farm Lease Form Doc 112kb 8 Page S Page 5 Legal Forms Blank Form Templates

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

:max_bytes(150000):strip_icc()/8379InjuredSpouseAllocation-1-03b68023b499432fabbad2fdc66b4b5e.png)

Form 8379 Injured Spouse Allocation Definition

Wisconsin Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Wisconsin Property Tax Exemption Form Fill Out And Sign Printable Pdf Template Signnow

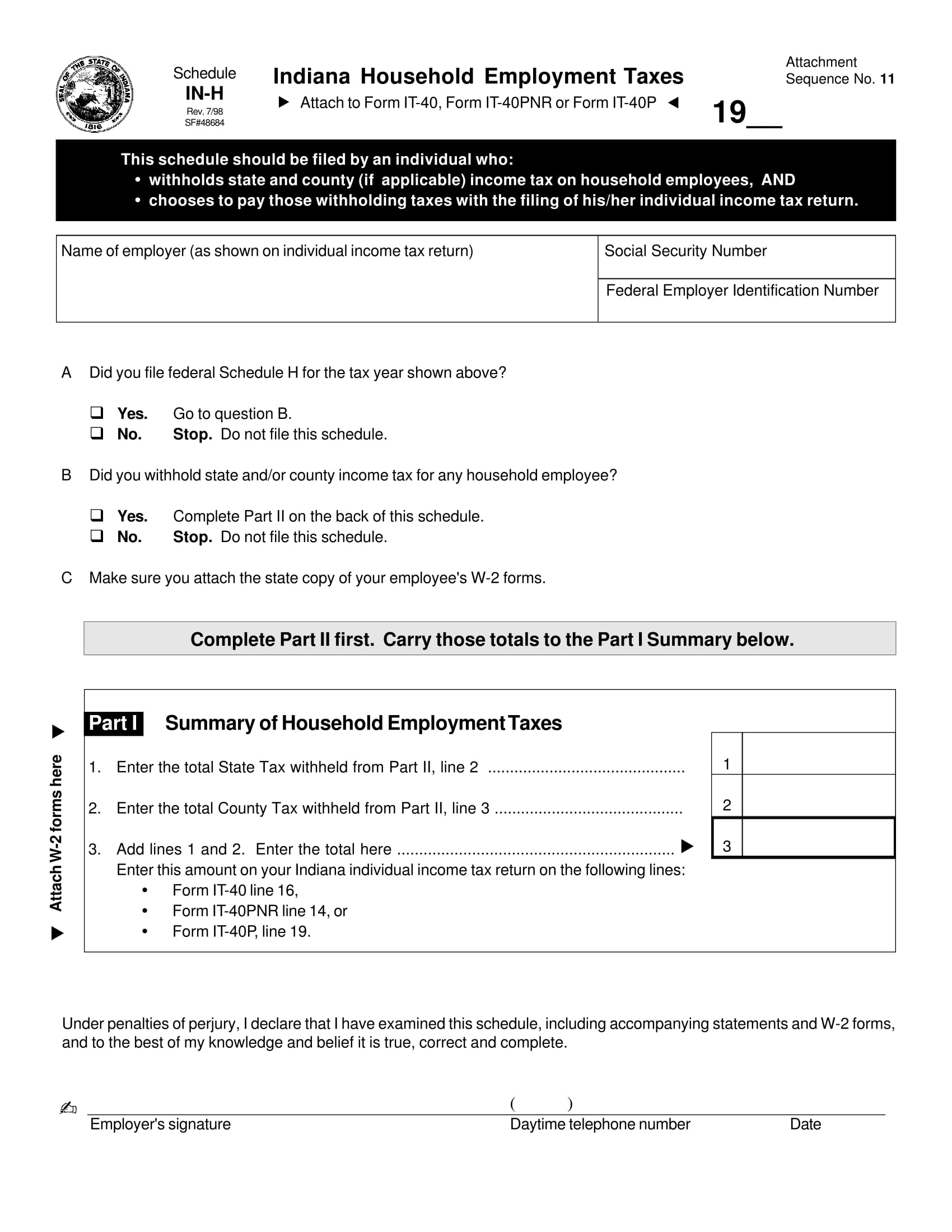

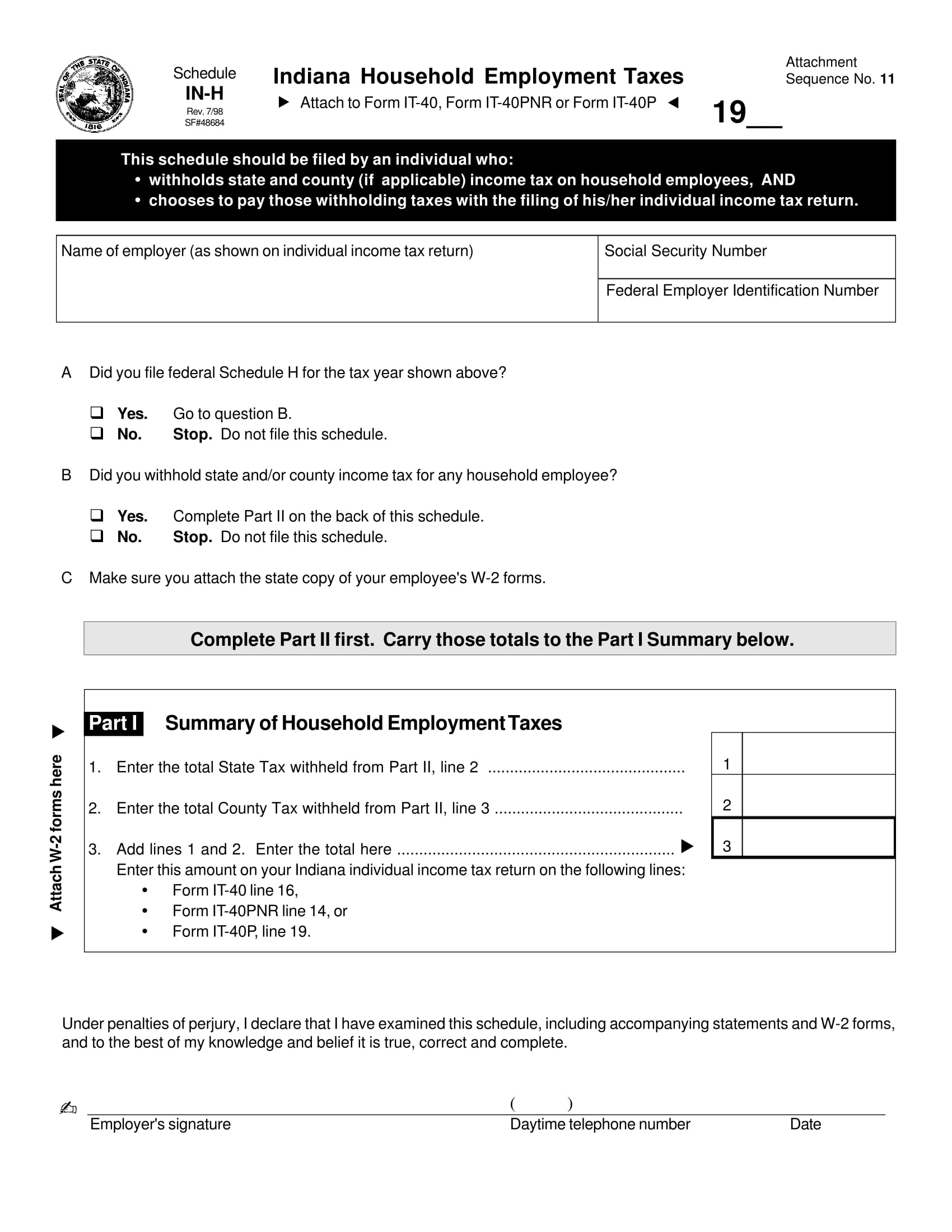

Free 20 The Taxpayer S Guide To Tax Forms In Pdf Ms Word Excel

State Of Wisconsin Tax Forms Fill Out And Sign Printable Pdf Template Signnow

Wisconsin Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Wisconsin Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Insurance Waiver Form Template 123 Form Builder

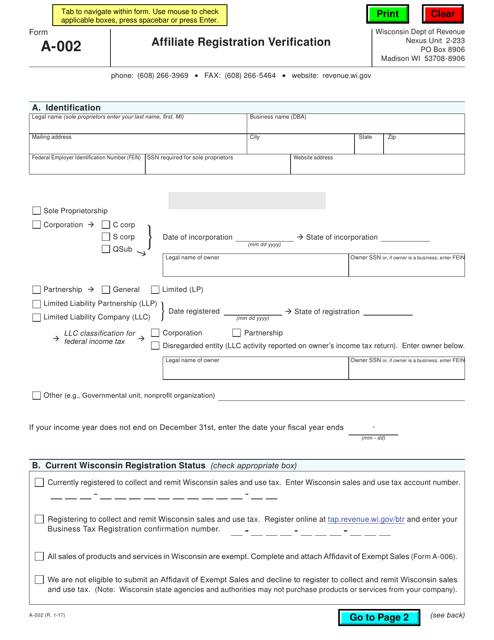

Form A 002 Download Fillable Pdf Or Fill Online Affiliate Registration Verification Wisconsin Templateroller

Nova Scotia Hall And Or Kitchen Rental Agreement Form Nova Scotia Rental Agreement Templates Scotia

Free Saskatchewan Pasture Lease Agreement Sample Pdf 118kb 6 Page S Page 4 Being A Landlord Repair And Maintenance Lease Agreement