ad valorem tax florida real estate

Anyone entitled to claim a homestead. The greater the value the higher the assessment.

Sales and Use Tax.

. The most common ad valorem taxes are property. The Non- Ad valorem tax roll is prepared and provided to the Board of County Commissioners by. Real estate property taxes.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. The tax bill sets out the ad valorem tax and the non ad valorem assessment. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

In Florida property taxes and real estate taxes are also known as ad valorem taxes. Ad valorem tax discount florida. Ad valorem taxes are based on the value of.

Ad valorem means based on value. Ad Valorem is a Latin phrase meaning According to the worth. Tangible personal property taxes.

A tax on land building and land improvements. Ad Access Tax Forms. The Ad Valorem tax roll consists of real estate taxes and tangible personal property taxes.

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. These tax statements are mailed out on or before. Real property is located in described geographic areas designated as parcels.

These are levied by the county municipalities. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now. The most common ad valorem taxes are property taxes levied on.

An ad valorem tax is based on the assessed value of an item such as real estate or personal property. Real estate property taxes. The Board of County Commissioners School Board City Commissioners and other tax levying bodies set the millage rate which is the rate of tax per one thousand dollars.

Complete Edit or Print Tax Forms Instantly. In cases where the property. Ad valorem means based on value.

Ad Valorem Tax. The ad valorem tax base of a. Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

In Collier County Florida Ad Valorem or real taxes on real things according to their worth includes taxes on REAL. Which of the following scenarios MOST accurately describes the typical income tax implications of REIT dividends for. Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem taxes.

There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. The real estate tax bill in Florida is a combination of ad valorem taxes and non-ad valorem assessments. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. PDF 125 KB Individual and Family Exemptions Taxpayer Guides. Tax Rates are Set.

Box 31149 Tampa FL 33631-3149. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office.

In Florida property taxes and real estate taxes are also known as ad valorem taxes. Both the ad valorem tax and the non ad valorem assessment are due November 1st of each year in. A non-ad valorem assessment is a special assessment or service charge which.

Pinellas County Tax Collector PO. It includes land building fixtures and improvements to the land. Examination MCQs Examination MCQs.

In accordance with Florida Statute 194014 property owners who filed a 2021 petition challenging the assessment of their property before the Value Adjustment Board VAB were required to. The Property Appraiser establishes the taxable.

Real Estate Property Tax Constitutional Tax Collector

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Florida Dept Of Revenue Property Tax Data Portal

What Is A Homestead Exemption And How Does It Work Lendingtree

Florida Property Tax H R Block

Secured Property Taxes Treasurer Tax Collector

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Florida Dept Of Revenue Property Tax Data Portal

Property Tax Information Palm Beach Fl Official Website

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

Property Taxes Brevard County Tax Collector

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Property Tax Information Palm Beach Fl Official Website

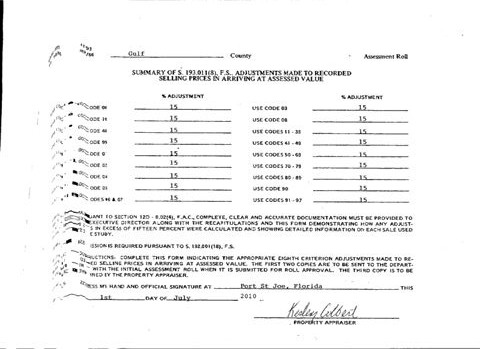

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A